Victoria’s property market, especially Melbourne, hasn’t seen the same level of growth as some other states, but that’s precisely what makes it an attractive option for savvy investors right now.

While some cities like Brisbane have surged post-COVID, with around a 60% increase, Melbourne has only seen 9% growth. This slower growth, combined with the strength of Victoria’s economy, makes for an interesting opportunity for those who know where to look.

One of the appealing factors with Victoria right now is affordability. In Melbourne’s northern suburbs, for example, investors are finding properties under $600,000, which is rare in other major markets.

This lower price point has resulted in high demand, particularly in areas where you can still buy a free-standing home on a decent plot of land—something that’s becoming increasingly difficult in places like Brisbane and Sydney. The demand is strong, especially among first-home buyers and first-time investors looking for a solid entry point into the market.

Another advantage Victoria has over other states is its competitive holding costs. At first glance, Victoria’s higher land tax might seem like a deterrent, but when you look at the full picture, the costs are more balanced.

For example, council rates, water charges, property management fees and insurance are generally lower than in Brisbane. In Queensland, property management fees can be as high as 8%, whereas Melbourne’s averages around 5-6%. Insurance is also significantly cheaper, with Queensland premiums reaching up to $2,500, compared to Melbourne’s more reasonable $1,000-$1,500 (comparison is based on a 3 bedroom home). When you factor in these costs, the net cash flow position can be quite similar, making Melbourne a viable and often overlooked option.

With Melbourne’s slow growth and more accessible price points, interest in Melbourne’s lower-value markets is heating up. Suburbs like Dallas have seen increased inquiries, especially from investors outside the state. This also reflects a broader trend that we’re seeing with investors moving away from high-growth markets that may now be overpriced and looking for areas with better affordability and room for more upside.

Ironically, Melbourne’s underperformance since COVID presents a good buying opportunity, especially with lower entry costs in certain suburbs. With the national and Victorian elections approaching in 2025 and 2026, many expect some favourable policy shifts that could positively impact property values.

On top of that, rate cuts expected in the coming year could provide a further boost to buyer sentiment and affordability, and in the process boost market activity, possibly even leading to an uptick in prices.

As we’ve seen in other capital cities like Perth, the market is cool, until it’s not. In just a few years, Perth went from being completely ignored, to being flooded with demand.

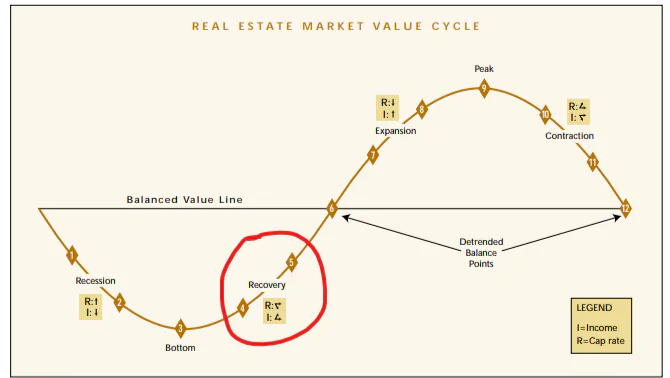

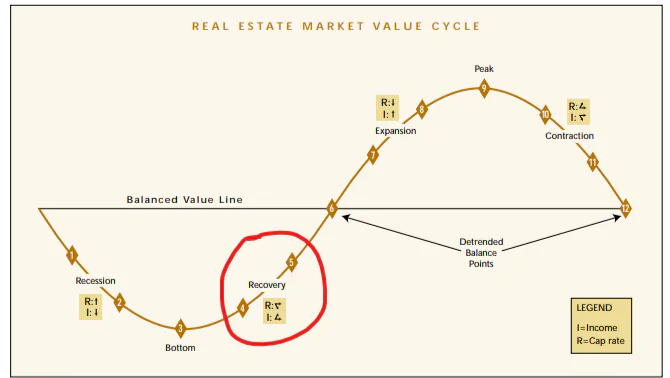

While predicting market cycles is never an exact science, the underlying fundamentals in Victoria, particularly Melbourne, suggest the potential for considerable growth as the market rebalances.

Another factor drawing investors to Melbourne is the availability of land and the steady demand for housing. Unlike some other states, Victoria has maintained consistent wage growth of around 4% annually over the last two years, while property prices have actually fallen away in that same period. This means that the affordability gap is closing, creating an attractive environment for new buyers.

For now, we are starting to see those early signs of life in the market. Especially at the lower end. Ideally, you want to be positioning yourself early so that when the market does finally kick into top gear, you are well positioned for the initial burst of growth.